Banking and Credit

Since the Great Depression, Congress has passed a series of laws to preserve stability in the banking and credit industries, protect consumers from unfair and deceptive practices and make affordable credit available to middle class and low-income families and small businesses. Beginning in the 1980s, the deregulation of financial institutions has fed speculative booms and devastating busts. Privatization of low-cost government credit for student loans and mortgages and weaker consumer protections has driven up the cost of credit and put consumers at risk.

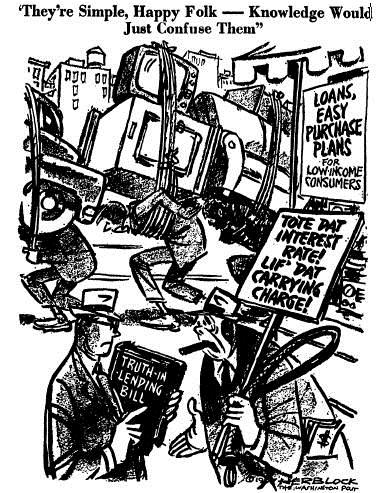

Commentary

Information is power… and that’s the problem

Why #OccupyWallStreet?

Cry Wolf Quotes

The Community Reinvestment Act does not appear to have had any positive effect on lending to residents of LMI neighborhoods. In fact, it appears to have had a negative effect on CRA lenders and LMI residents alike… While both CRA- and non-CRA lenders have increased the number of loans to low-income borrowers, the financial soundness of CRA-covered institutions decreases the better they conform to the CRA.

You're wrong in stating where the problem came from. The problem came from this notion that everybody in America had a right to a house whether they could ever afford to pay their loan back. That's what the Community Reinvestment Act was all about.

ABA is very concerned about the direction this legislation is headed and we are concerned over the impact it will have on the ability of consumers, students and small businesses to get credit cards.

It is simply wrong-headed policy…[Federal and state banking regulations] require or aggressively nudge banks into subsidizing parts of the community [The proposals] would only aggravate the problem.

Related Laws and Rules

Evidence

-

Banking Lobby's Warnings About CARD Act Disproven

What happened after credit card reform bill passed Congress in 2009 (it worked).

-

The Successes of the CARD Act

The Consumer Financial Protection Bureau describes exactly what the act did and what the effects were one year later.

Backgrounders & Briefs

A Timeline of the CARD Act

An interactive timeline of credit card reform.

Resources

The National Community Reinvestment Coalition works against unfair lending and banking practices, particularly those targeted towards low and middle income families.