Banking and Credit

Since the Great Depression, Congress has passed a series of laws to preserve stability in the banking and credit industries, protect consumers from unfair and deceptive practices and make affordable credit available to middle class and low-income families and small businesses. Beginning in the 1980s, the deregulation of financial institutions has fed speculative booms and devastating busts. Privatization of low-cost government credit for student loans and mortgages and weaker consumer protections has driven up the cost of credit and put consumers at risk.

Commentary

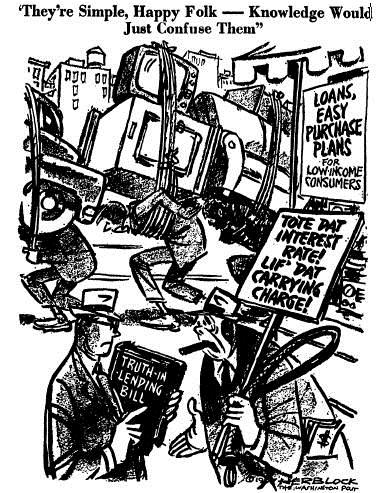

Information is power… and that’s the problem

Why #OccupyWallStreet?

Cry Wolf Quotes

The CRA, by encouraging loosening underwriting standards, may have contributed to the massive increase in foreclosure rates.

They say, ‘Well, this is a failure of the markets. Oh, this is about greed on Wall Street.’… the problem here is government intervention in the free markets. 1995, when Bill Clinton decided to tell, you know, [then-Treasury Secretary] Robert Rubin to rewrite the rules that govern the Community Reinvestment Act and push all these institutions to lend to minority communities, many were very risky loans. That was a noble idea, perhaps, but that certainly wasn't following free-market principles. This big pressure on institutions to dole out money and these risky loans started this whole ball rolling at Fannie and Freddie.

There’s little doubt that the rating agencies helped inflate the housing bubble. But when we round up all the culprits, we shouldn’t ignore the regulators and affordable-housing advocates who pushed lenders to make loans in low-income neighborhoods for reasons other than the only one that makes sense: likely repayment… in 1995 the Clinton administration added tough new regulations. The federal government required banks that wanted 'outstanding' ratings under the act to demonstrate, numerically, that they were lending both in poor neighborhoods and to lower-income households. Banks were now being judged not on how their loans performed but on how many such loans they made. This undermined the regulatory emphasis on safety and soundness.

…the government has used regulatory and political pressure to force banks and other government-controlled or regulated private entities to make loans they would not otherwise make and to reduce lending standards so more applicants would have access to mortgage financing… the CRA was used to pressure banks into making loans they would not otherwise have made and to adopt looser lending standards that would make mortgage loans possible for individuals who could not meet the down payment and other standards that had previously been applied routinely by banks and other housing lenders... a law that was originally intended to encourage banks to use safe and sound practices in lending now required them to be innovative and flexible--a clear requirement for the relaxation of lending standards.

Related Laws and Rules

Evidence

-

Banking Lobby's Warnings About CARD Act Disproven

What happened after credit card reform bill passed Congress in 2009 (it worked).

-

The Successes of the CARD Act

The Consumer Financial Protection Bureau describes exactly what the act did and what the effects were one year later.

Backgrounders & Briefs

A Timeline of the CARD Act

An interactive timeline of credit card reform.

Resources

The National Community Reinvestment Coalition works against unfair lending and banking practices, particularly those targeted towards low and middle income families.